What are pulse surveys?

Pulse surveys give organisations the freedom to measure whatever they think is important on a regular basis, and are particularly effective as part of an employee listening program.

In our experience, the term “pulse” is often used to refer to everything that’s not an annual or bi-annual employee engagement survey. Pulse surveys are different from engagement surveys, lifecycle surveys (onboarding, exit, candidate reaction, etc.), and ad-hoc employee surveys.

Pulse surveys are a mechanism for measuring feedback using shorter, more frequent check-ins, that’s not bound to measuring specific topics or content.

This means that the content being measured can (and should) change from organisation to organisation and even from one survey to the next.

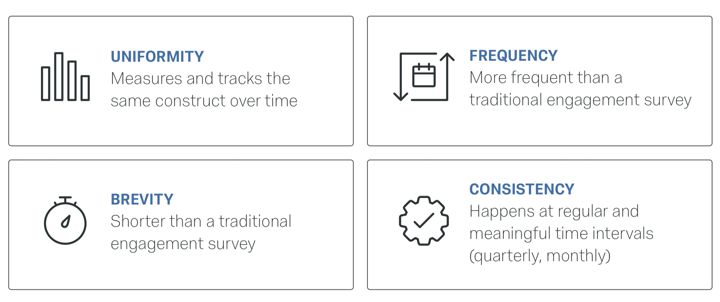

Pulse surveys:

- Track the same item over time, e.g. “How likely are you to recommend your company as a place to work to people you know?”

- Are shorter than an engagement survey, and easier to complete

- Are more frequent than traditional surveys (more than once a year)

Happen at a regular interval (most organisations use them quarterly or monthly)

Pulse surveys are just one of a number of different employee feedback mechanisms you could choose to use outside of an engagement survey.

What are the advantages of pulse surveys?

Pulse surveys are popular, not only because they are shorter and reduce the amount of time it takes employees to give their feedback, but also because they introduce a new dimension to results analysis: tracking over time.

Where an annual engagement survey is a once-a-year snapshot of your employees’ engagement, pulses allow you to track items month-to-month or quarter-to-quarter so you can:

- check in (and react) more regularly

- plot trends over time

- start to link improvements back to actions

Pulse surveys are also more agile than traditional, infrequent survey methods. Asking for feedback once a year means it’s incredibly difficult to check in on the progress of action plans, as well as being difficult to align feedback measurements with business outcomes.

With pulse, employees have the opportunity to provide feedback more frequently, and organisations have the chance to react more quickly to that feedback.

Our research shows that employees want to provide feedback more regularly:

- 77% of employees want to provide feedback more than once per year

- Most employees would prefer to provide feedback four times per year

Want to get started with your own pulse surveys? Take a look at some of our free Employee Experience (EX) survey templates: GET STARTED

Why use pulse surveys?

Employees feel valued and heard when they have the opportunity to provide more frequent feedback. People are 12 times more likely to recommend their employer if they feel like their feedback is being listened to and actioned.

Pulse surveys can be used to measure anything that matters to employees and the business, including:

- helping maintain an early warning system for important business metrics, e.g. a safety pulse or customer service pulse

- measuring the effectiveness of action plans, particularly those implemented following a traditional engagement survey

- helping you to understand the relationships between different types of employee feedback, as well as other important business outcomes that are tracked frequently, such as voice of the customer(VoC), performance review, and turnover.

eBook: Use Employee Lifecycle Feedback to improve your EX

What can pulse surveys measure?

The short answer is: anything! Pulse surveys are a non-content-specific feedback method. What you ask can be tailored to your organisation’s priorities, goals, and what you need to track.

In fact, the only content-related mandate for a pulse is to have some consistency, so you’re able to track the same item over time and see how it changes from one month or quarter to the next.

That said, we do see synergies in the types of content organisations choose to measure with their employee pulse surveys.

Try our Employee Pulse Survey Tool for yourself

Common uses of pulse surveys

- Engagement pulse: this replaces the annual engagement survey, and is a shorter (maybe only 2-3 items) measure of employee engagement, along with measures of the core drivers of engagement, such as autonomy, career progression, or alignment to strategy

- Action planning follow-up pulse: run in conjunction with the annual engagement survey, this monitors the action plans set after that survey, with structured, regular feedback to help you measure progress and make changes to your plans, should you need to.

- Company values pulse: some organisations choose to track whether their company values are truly being “lived” in the organisation (sometimes forming part of a broader company culture initiative)

- Change pulse: used to check in on employee sentiment more regularly through an organisational change program.

Once you’ve identified your need for pulse surveys, they can be a valuable tool to bring the voice of employees into business decisions more regularly, which will enhance the overall employee experience.

Collect and apply employee feedback with our 360-Feedback eBook: Download Now

What questions should a pulse survey include?

There are no set questions as a pulse survey should be a strategic addition to your overall employee listening strategy.

Any pulse survey program requires an investment of time from your employees and your resources, so you should focus on only asking about things that are relevant, and important to your organisation.

Start with the organisation’s strategic priorities, then consider the HR department’s goals. One of the biggest mistakes organisations make is failing to include either outcomes or drivers in the survey.

For example, measuring only engagement will tell you nothing about why employees are engaged or disengaged, thereby making the survey unactionable.

When structuring your survey, we recommend using the 70:20:10 rule of thumb:

- 70% driver or actionable items

- 20% outcome questions/items

- 10% open-text questions/items

From there, consider including the following measurements:

- Engagement: most employee pulse surveys include some measure of engagement, e.g. “I am proud to work for this company” or a single item such as eNPS.

- Action planning themes: used to gauge the effectiveness of action plans that were implemented following the traditional engagement survey, e.g. ‘To what extent do you agree with the statement, “I have seen positive changes taking place as a result of previous surveys?”’

- Strategic initiatives, change, or product enhancements that would benefit from employee feedback e.g. “This company does a good job of helping me understand how changes will affect my work”.

- Low scoring or surprising survey items

- Employee reactions to new programs or initiatives

- Measurements that matter to executives

READ MORE: What questions to ask in a pulse survey

How long should a pulse survey be?

That the more frequent the pulse survey is administered, the shorter it should be, e.g:

- Monthly pulse: 10-15 questions

- Quarterly pulse: 15-20 questions

- Bi-annual pulse: 20-30 questions

READ MORE: How to avoid survey fatigue

Image credit to edume.com

Image credit to edume.com

How often should you use pulse surveys?

Two questions to ask are:

- How frequently does the business need to see results from the surveys?

- How quickly can the business respond to the results?

There are then four things to consider:

1. Fluctuations

How much does what you’re measuring fluctuate? Something like employee mood may fluctuate frequently, so you could measure daily or maybe more than once per day. However, if you’re measuring employee engagement, and its drivers, levels are unlikely to fluctuate in a short period of time, and daily or weekly measurements do not make sense.

2. Absorption and communication of results

An employee survey sets the expectation that leaders will use the results to take action. Failure to do this creates feelings of distrust and disengagement among employees and is a surefire way to decrease future survey response rates.

How often can your organisation react to survey results? You should be prepared to review each set of results and aim to understand them. When considering a suitable cadence for your pulse survey, think about how you’re going to be able to process and use the findings.

3. Time to implement action plans

Action does not necessarily follow from every pulse survey (a pulse check on the effectiveness of earlier action plans may show that additional action is not needed) but it’s important to plan for possible actions following each pulse survey. A business needs to at least factor in time to review, communicate, and decide on actions.

4. Cadence of other organisational metrics

Some organisations work quarter-to-quarter, some month-to-month and for others, everything revolves around the annual meeting.

In your pulse planning ask what the business needs the data for.

- If you’re simply reporting data to the board at the annual meeting, pulse might not be the right mechanism and you might choose an annual engagement survey instead.

- If you’re reporting monthly, however, you might want to match that cadence so you can provide fresh data each time and update the board on the improvements.

We find that quarterly is a popular pulse cadence because:

- Most organisations run their reporting on a quarterly cycle already

- It leaves time to review the data and put actions in place

- It allows surveys to be slightly longer, allowing for more topics to be included

What about survey fatigue?

Some organisations have reservations that their employees will suffer from survey fatigue by receiving surveys more frequently.

We have found that the biggest impact on fatigue is not so much survey frequency, it’s program communication: if employees don’t hear back about their feedback, or if communication is not managed well.

Ready to get your employees' pulse?

This article was written by the EmployeeXM team

Our EX Scientists are a global team of Employee Experience consultants who deliver advisory services for our clients to help them design and deliver world class EX strategies & programs. They provide empirically driven, best practice solutions.